PARTNERING WITH AN RIA – BUILDING YOUR FINANCIAL LEGACY IN 2025 AND BEYOND THROUGH THE 7 Ps

READ ARTICLEListen To Podcast

Partnering with an RIA – Importance of Perspective

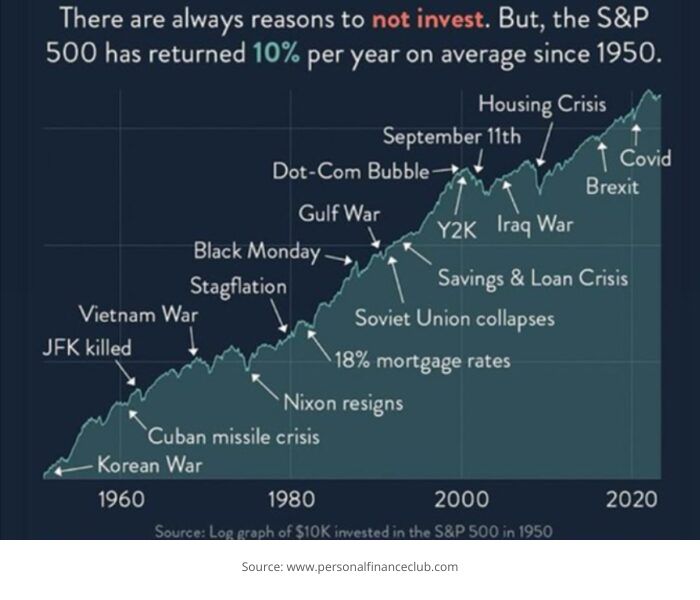

Given the current market environment, KYUR believes it’s important to partner with an RIA who has the portfolio management experience and perspective to navigate through different market cycles

Call Us NowListen to Podcast

PARTNERING WITH AN RIA – INVESTING IN AN ERA OF DEGLOBALIZATION

Thuy Tran, KYUR CIO, why now is the time to partner with an experienced RIA who has demonstrated they can manage money over several different market cycles (1.32) . And that global equity markets are entering an era of deglobalization that will lead to competitive dislocations within sectors which makes Active rather than Passive management the way to go (25.55)

READ ARTICLELISTEN HERE

You are Unique, So are Your Investments

WE HELP YOU BUILD YOUR FINANCIAL LEGACY FOR FUTURE GENERATIONS

WITH KYUR'S TOTAL WEALTH SOLUTIONS

Call Us NowRisk Temperature

KYUR®

(“CURE My Investments”) – TO PROTECT CAPITAL AND OPTIMIZE RETURNS

Risk Control is Our Focus

Brings you high-value and customized investment solutions accessible previously only by the wealthy and institutions.

Solutions are driven by our proprietary quantitative PMO engine which measures risks by incorporating a better understanding of investing in inefficient non-normal risky markets. For strategic investors to invest with confidence.

The KYUR® Approach

KYUR® is a fundamental quantitative bottom-up stock picker.

It seeks positive returns in varying market conditions. With low dependence/correlation to the equity market. By applying a disciplined quantitative approach to pick stocks with strong potential of excess return (alpha), independent of market directions. And rigorously managing risks. KYUR® is staffed by a seasoned team of experts trained at leading universities, with 100+ years of combined high-level experience in large investment firms serving institutional and HNW investors.

KYUR® applies the same philosophy, approach, and strategy to serve investors who might just begin to invest, as well as long-established institutions that students depend on for scholarships, retirees for pension, or HNW families seeking to grow their wealth for future generations.

Driven by our PMO (Post Mean-Variance Optimization) discipline and quantitative algorithms, KYUR® selects investments and constructs portfolio solutions that are customized to suit investor personal situations and risk- tolerances –to help achieve their long-term goals.

KYUR® quantitatively measures your risk tolerances by the amounts and probabilities of capital losses to your investments that you are willing to tolerate, as well as your personal circumstances— not volatility as used in Modern Portfolio Theory (“MPT”), or characterizations like “conservative” or “aggressive” as in traditional ad hoc approaches.

PMO encapsulates better understandings of risk attitudes from the works led by Nobel Laureate (2002) Daniel Kahneman of Princeton University on real-world rational behavior, and important innovations in risk measurement mathematics advanced in the last two decades.

KYUR® Products

We offer easy access to high-value quality investment solutions that control risks of capital losses so you can save and grow wealth.

With confidence.

Alpha Growth

Alpha Growth KYUR’s flagship equity strategy. It seeks optimal long-term capital appreciation from alpha, and with reduced correlation (R-squared) to the stock market. By employing a fundamental bottom-up quantitative discipline.

Total Wealth

Total Wealth is an equity multi-strategy, combining long-only, long/short, and alternative strategies. It seeks to deliver consistent long-term capital growth with modest correlation to the market.

Pure Alpha

Pure Alpha is a long/short equity strategy. It seeks positive returns in both market ups and downs, with minimal correlation to the equity market. By buying those stocks that possess attractive growth prospects.

LEARN MORE about KYUR® Quantitative Alpha Strategies

Ready to get started?

It’s your future – start planning now – KYUR can help.

Full Living

In a survey, 59% of the very wealthy (“UHNW”) say their biggest anxiety is running out of money. This worry runs across the young and the older. Among the UHNW under 40 years old, 44% say their top concern is running out of money; 65% of those between 40 and 59 say so.

Financial Planning & Beyond

Consistent return is critical in wealth accumulation as well as in investment and retirement planning. It is not so much the big short-term gains, but the compounding effects of steady returns that determine final wealth.

Beyond Wall Street

“HAVING long fretted over the state of our retirement system, I was delighted that the Department of Labor is vigorously defending its new rule requiring brokers to recommend only investments that are in the best interests of holders of retirement accounts.” Steve Rattner.

Partnering with an RIA – Building your Financial Legacy in 2025 and Beyond through the 7 Ps

The end of the year is typically marked by New Year’s resolutions and goals related to health, family and career. It is equally as important to assess whether 2024 financial goals were met and setting those for 2025 and beyond. Partnering with a Registered Investment Advisor (RIA) can be invaluable in helping you achieve your financial goals. Importantly, RIA’s have a fiduciary duty to act in the best interests of their client.

Your opinion is very important to us.

Please send us your comments and feedback to info@KYUR.co

KYUR, Inc

620 Newport Center Drive, Newport Beach, CA 92660

Performance Disclosures

KYUR Inc. (“Company”) is a Registered Investment Adviser. Information with regard to investment performance presented herein is generated from the Company’s proprietary quantitative algorithms, and mathematical formulae developed by the Company. Both are aimed at capturing the factors and the return generating processes that cause stock prices to rise or fall over time, and thereby the model returns of the selected stocks’ and the portfolios constituted thereof. It is intended for information purposes only, and should not be interpreted as actual results. Investments involve risks which may not be foreseen or foreseeable. Model performance is NOT an indicator of future actual results. There are limitations inherent in model results particularly that the performance results do not represent the results of actual trading using client assets, but were achieved by means of application of models that were designed based on a set of theories, empirical data, and assumptions about how stock prices change. The results reflect performance of strategies not historically offered to investors and do NOT represent returns that any investor actually achieved. Specifically, model results do not reflect actual trading, or the effect of factors not incorporated in the model assumptions, such as geopolitical upheavals, natural disasters, or changes in government policies and regulations. Since trades have not actually been executed, results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity, and may not reflect the impact that certain economic or market factors may have had on the decision-making process. Actual results may differ significantly from model performance.