HOW TO MEASURE RETURN?

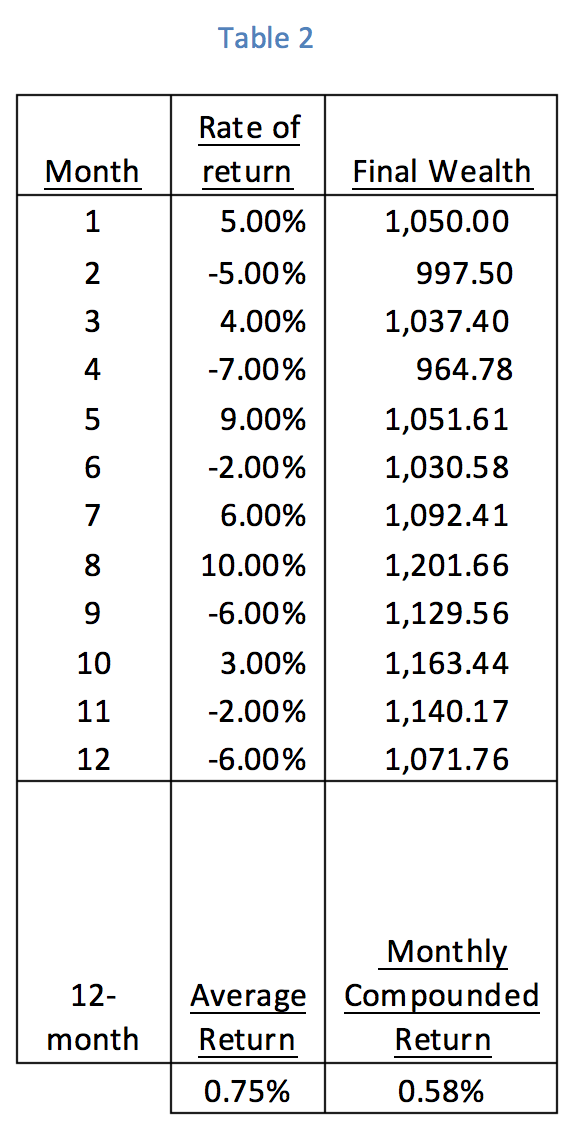

In MVO, rate of “return” or “return” is defined as the simple average or arithmetic average of the periodic (usually monthly) returns of a series of periods, say, the average monthly return of the 12-month period from January to December of a year. See Table 1.

According to these data, the average monthly return is 0.75%. In Xcel, you just use the function =AVERAGE(A1:A12).

In MVO, the average periodic return data you predict for your investments are used as input to the MVO algorithm to construct your optimal portfolios. They are called Efficient Portfolios in MVO. An Efficient Portfolio is one that a) there exists no other portfolio that has higher return with the same risk (i.e., volatility), and b) there exists no other portfolio that has the same volatility with higher return.

So, what is your total return for the 12-month period?

You may be inclined to multiply 0.75% by 12, for a 12-month return of 9.00%. Let’s say you had invested $1,000 at the start; you would think that at the end of 12 months, you had $1,090.00.

Alternatively, you may use the compounding method to calculate what you’d have after 12 months. You would multiply $1,000 by 1.0075, and at the end of the first month you have $1,007.50. The value of your investment at the end of month 2 would be $1,015.06, (multiply $1,007.50 by 1.0075), and so on. At the end of 12 months, you would think your investment was worth $1,093.81, for a 12-month return of 9.38%.

ACTUALLY, YOUR INVESTMENT’S RETURN WAS LOWER.

ACTUALLY, YOUR INVESTMENT’S RETURN WAS LOWER.

In the above, you used the average return according to MVO to calculate your monthly return.

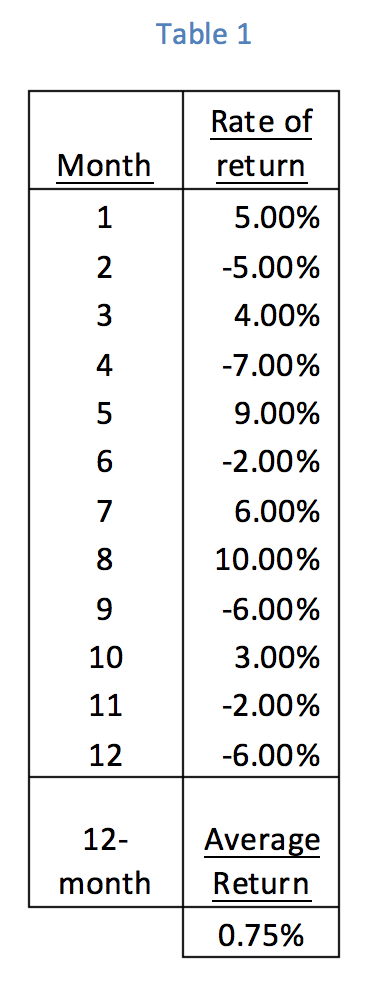

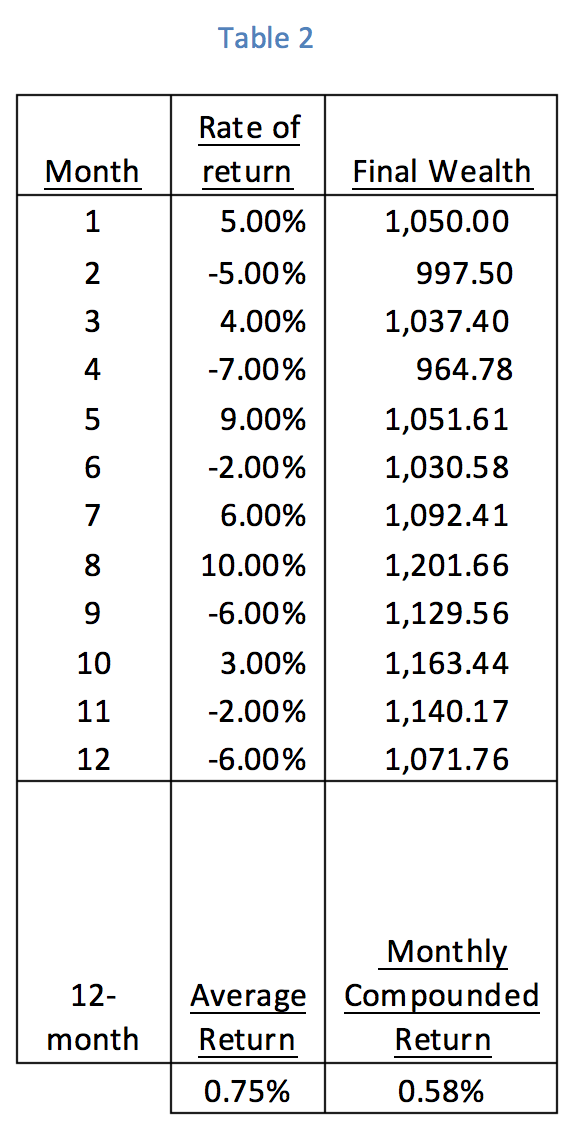

Refer to Table 2 for the ACTUAL value of your investment at the end of each month. Using the same data from Table 1, your return would be really only 0.58% per month or 7.18% 12-month; neither 9.00% nor 9.38%. After 12 months, your investment was worth only $1,071.76. Your actual gain would be less than the “average” calculation used in MVO.

This is because your initial investment of $1,000 increased to $1,050.00 after the first month, then declined to $997.50 after the second month due to a loss of -5% in that month. You may note that the magnitude of the loss in month 2 of -5% was the same as the gain of 5% in month 1, yet your investment was $2.50 less.

Each month, your investment is exposed to the actual gains or losses, not the average of a 12-month period, looking back or forward.

THE METHODOLOGIES MEASURING RISK AND RETURN EMBEDDED IN MVO MAY MIS-STATE THE ACTUAL EFFECTS ON FINAL WEALTH –AND CAN NOT EFFECTIVELY DIFFERENTIATE THE RISKS OF GOOD V. BAD INVESTMENTS.

In Table 2, the large gains of 9% in month 5 and 10% in month 8, while exhilarating, barely make up for the smaller losses in some of the other months.

The gain of 10% in month 8 was impressive, but the smaller losses that followed virtually wiped out the gains made during the year.

LOSSES ARE HIGLY DAMAGING TO YOUR PORTFOLIOS. After a loss of 50%, you would need a gain of 100% to recover to the initial value.

Suppose your investment had return of 5% every month for 11 month in a row, then, recorded a loss of 50% in month 12. Your average monthly return of the 12-month period would be 0.42%, if calculated as in MVO; maybe not great, but positive. You still had a profit!

In fact, your investment had a loss of ($144.83), or (14.48%). The large gain in value of $795.86 or 79.58% painstakingly accumulated during the first 11 months was wiped out by a loss of 50% in month 12.

LOSSES OCCUR QUICKLY. RECOVERIES TAKE MUCH LONGER TIME.

Interestingly, let’s suppose you have an investment generating returns of 0.42% monthly for 12 months in a row. By any means, its monthly return is not as impressive as 5% per month. Nevertheless, your wealth after 12 months would rise to $1,051.58, for profit of 5.15% in total.

MPT posits that investment decisions depend on two variables: risk and return.

MPT posits that investment decisions depend on two variables: risk and return.

ACTUALLY, YOUR INVESTMENT’S RETURN WAS LOWER.

ACTUALLY, YOUR INVESTMENT’S RETURN WAS LOWER.