Better understandings of the nature of risks, risk measurement, risk attitudes and decision-making under risks have come forward since Nobel Laureate Markowitz published his seminal article “Portfolio Selection” two-thirds of a century ago.

Beyond Modern Portfolio Theory

Below we briefly cite a few works in MPT literature and behavioral economics which shed new lights on the interplay of risk and return in investment decision-making:

“Portfolio optimization has come a long way from Markowitz (1952)”. Pavlo Krokhmal, Jonas Palmquist and Stanislav Uryasev, “Portfolio Optimization with Conditional Value-at-Risk,” September 25, 2001.

“Many of the difficulties we encounter in performance measurement and attribution are rooted in the over-simplification that mean and variance fully describe the distribution of returns.” Con Keating and William F. Shadwick, “A Universal Performance Measure,” January 2002.

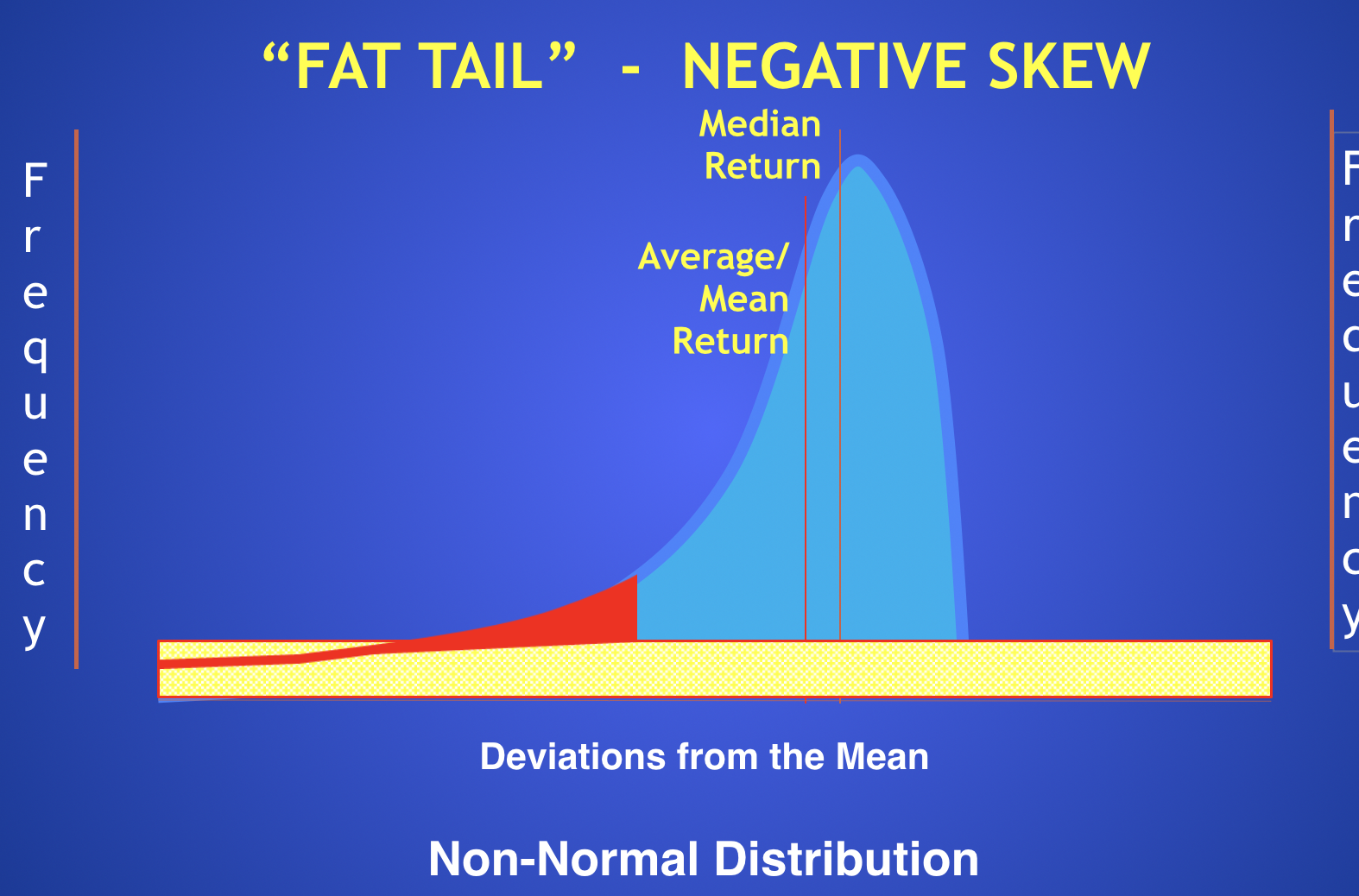

“Asset class return distributions are not normally distributed, but the typical Markowitz MVO framework that has dominated the asset allocation process for more than 50 years relies on only the first two moments of the return distribution. Equally important, considerable evidence shows that investor preferences go beyond mean and variance to higher moments: skewness and kurtosis. Investors are particularly concerned about significant losses—that is, downside risk, which is a function of skewness and kurtosis.” James X. Xiong, CFA, and Thomas M. Idzorek, CFA, “The Impact of Skewness and Fat Tails on the Asset Allocation Decision,” Financial Analysts Journal, Volume 67, Number 2, March/April 2011.

“Asset allocation is very important, but nowhere near 90 percent of the variation in returns is caused by the specific asset allocation mix. Instead, most time-series variation comes from general market movement, and Xiong, Ibbotson, Idzorek, and Chen (2010) showed that active management has about the same impact on performance as a fund’s specific asset allocation policy.” Roger G. Ibbotson, “The Importance of Asset Allocation,” Financial Analysts Journal, Volume 66, Number 2, March/April 2010.

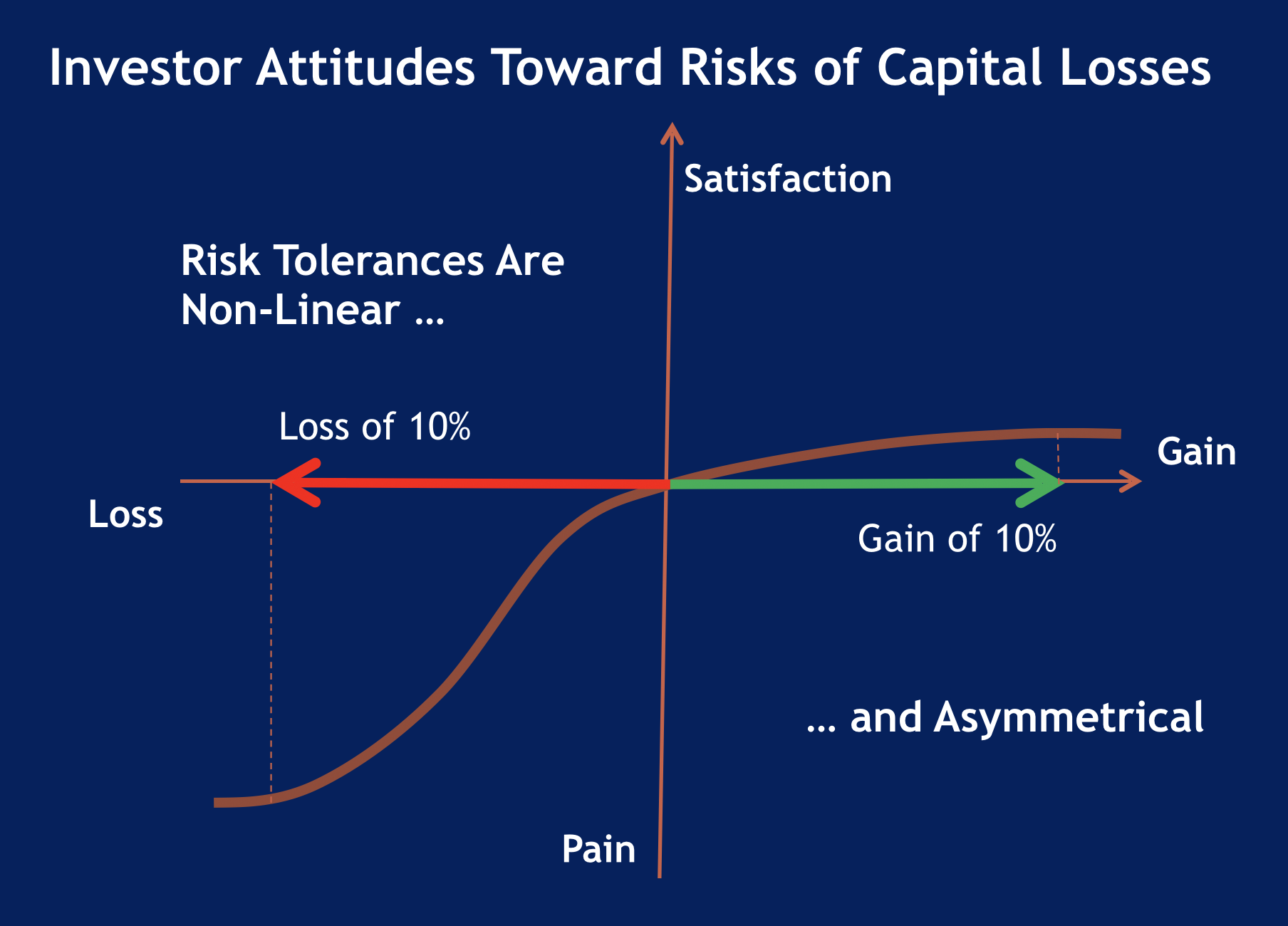

In the seminal work “Prospect Theory”, Nobel Laureate in Economics Daniel Kahneman and co-author Amos Tversky posit that investors feel greater pain from a loss than satisfaction from gains of the same amount.

The value function is steeper for losses than for gains –See graph. Additionally, due to a phenomenon called “diminishing sensitivity,” the value function is concave for gains and convex for losses, yielding risk-averse attitudes in the domain of gains and risk seeking in the domain of losses.

This means that investors tend to hold onto losing investments longer than they should, despite high probabilities of larger losses. Conversely, investors tend to sell winning investments early despite high probabilities of prospectively larger gains.