Trending

Survey: Breaking the Taboo

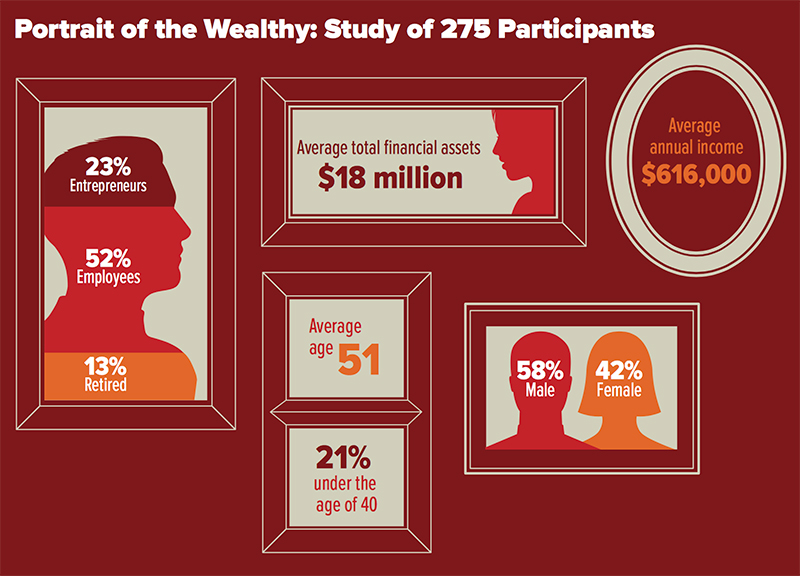

In this survey by SEI Private Wealth Management, next to the fear that they will run out of money, or “go back,” wealthy Americans worry about passing their wealth to the next generation. “Wealth is about much more than money. Families want to be sure their wealth has meaning and that family values and vision are shared among multiple generations.”

The study suggests that “a goals-based investing program can help address common concerns… facilitates regular conversation [among family members] and engagement, which results in a clearer picture of both wealth and values.

You can access the full report here.

Final Wealth

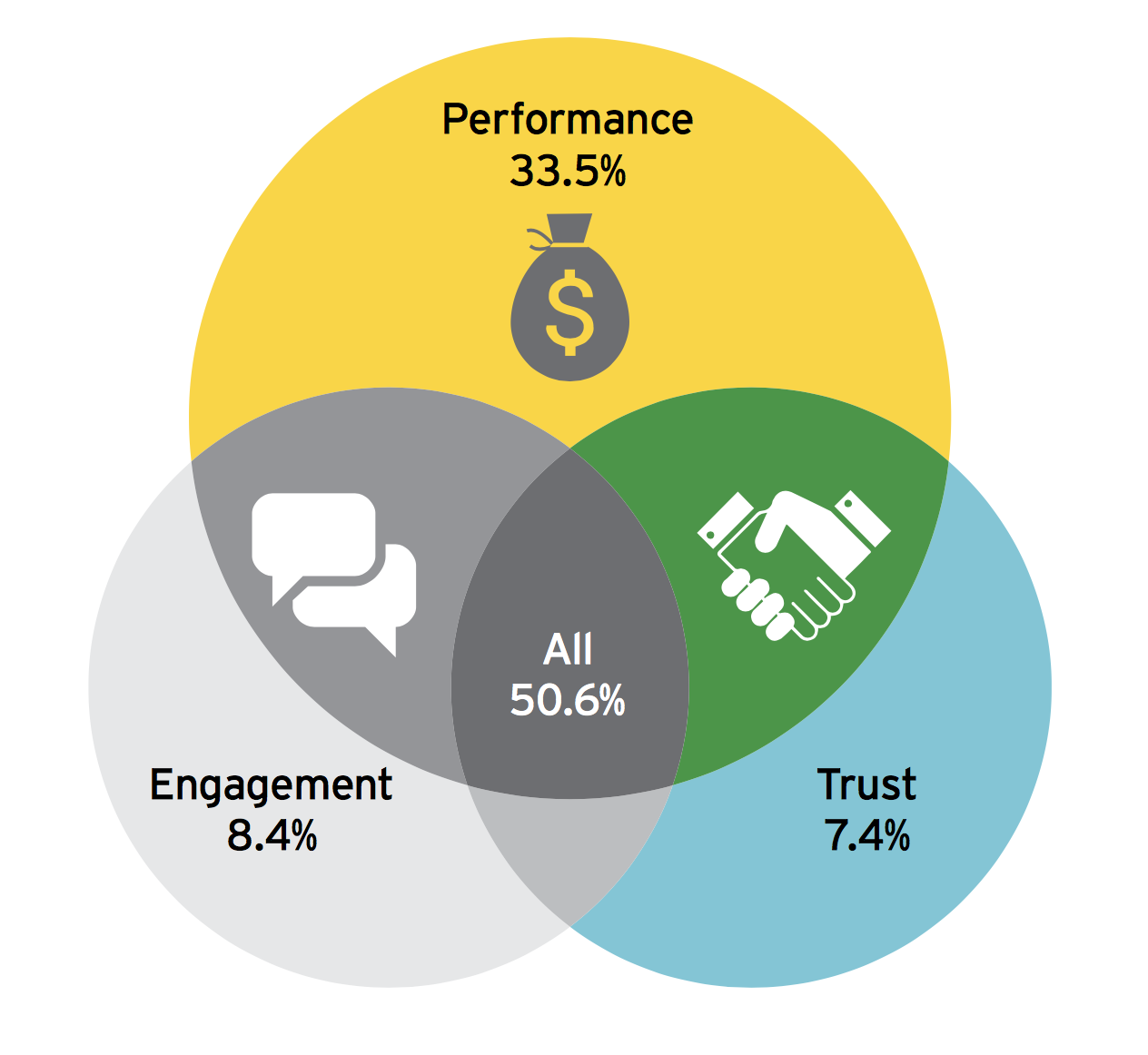

A report by the consulting firm EY (formerly Ernst & Young) based on a global survey of 2,000 wealth management clients and 60 wealth management executives found that “67 percent of people didn’t put financial performance as their most important factor.”

The report also found that mass affluent millennials from North America have the greatest preference for fulfilling their goals (42%) versus beating the market (26%)while 51% of ultrahigh-net-worth (UHNW) millennials globally view outperforming the market as important to them.

You can access the full report here

Best Interests: ‘Customers First’ to Become the Law in Retirement Investing.

The Labor Department, after years of battling Wall Street and the insurance industry, issued new regulations that will require financial advisers and brokers handling individual retirement and 401(k) accounts to act in the best interests of their clients.

You can access the full article here.

Rather: Pension Holders Need a New Retirement Plan, Not Stock Tips

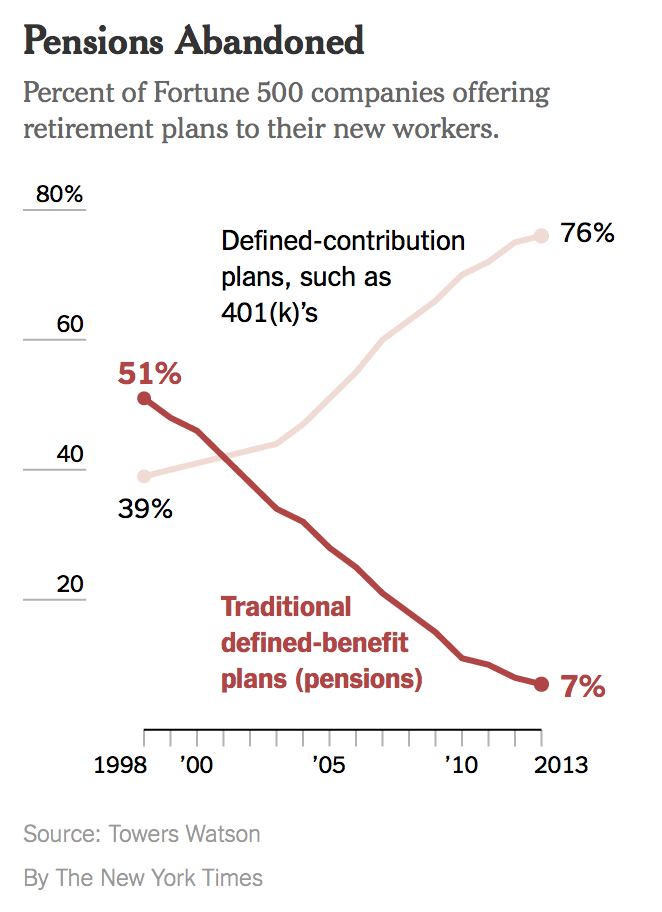

So wrote Steve Rattner in a New York Times op-ed article. He continued, “,,, about two decades ago, faced with mounting costs and increased regulatory burdens, employers began replacing traditional plans with “defined contribution” plans like 401(k)’s.

So wrote Steve Rattner in a New York Times op-ed article. He continued, “,,, about two decades ago, faced with mounting costs and increased regulatory burdens, employers began replacing traditional plans with “defined contribution” plans like 401(k)’s.

That created two immense problems. First, only about 10 percent of participants have been contributing the maximum amount allowable.

As a consequence, the average American household approaching retirement in 2013 had just $111,000 in 401(k)’s and I.R.A.s, a fraction of the six to 11 times annual earnings needed to be financially secure, according to calculations by Alicia Munnell, an economist and retirement expert at Boston College.

More important, the move to defined-contribution plans turned every American with a retirement account into an investment manager — a tough business for even the savviest professionals.

More important, the move to defined-contribution plans turned every American with a retirement account into an investment manager — a tough business for even the savviest professionals.

Last November, Goldman Sachs — an exceptional firm — issued six investment recommendations for 2016: buy stocks in large banks, sell yen and so forth. In early February, Goldman abandoned five of them, after huge losses in just a few short weeks.

Nor are the Wall Street firms’ records with individual stocks anything to brag about. In this year’s first quarter, the stocks rated highest by analysts fell and the stocks rated lowest rose.”

(Editor’s note: Steven Rattner is a Wall Street executive, former investment banker at Lehman Brothers, Morgan Stanley, and Lazard Freres & Co. and a contributing writer to The New York Times Op Ed page.)

You can access the full article here.