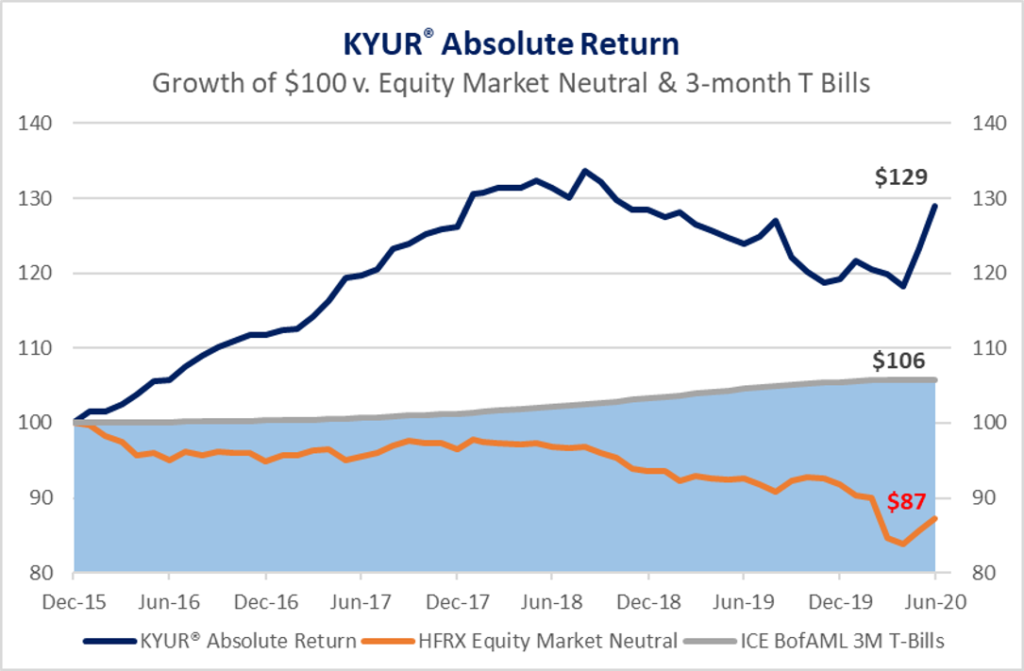

Absolute Return is a long/short equity strategy, designed as an alternative investment for fixed income or cash-equivalent investors who seek absolute return with low volatility.

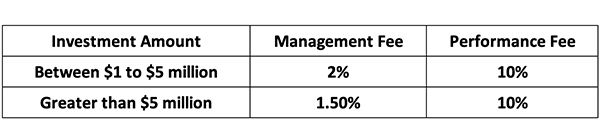

KYUR Absolute Return is offered to Qualified Investors. If you are a Qualified Investor, please complete the qualified investor certification form.

Absolute Return invests in equity securities with a U. S. focus, but also includes select global opportunities. Driven by our proprietary PMO quantitative engine, with added consideration for macro and industry specific factors, Absolute Return calibrates stock markets’ intrasector dispersions and mis-pricings for alpha generation, or non-correlated returns from individual stocks. Its objective is to generate consistently positive absolute return with low volatility. Absolute Return has a market neutral stand, and an emphasis on rigorous portfolio discipline and control of risks of capital losses.

Investments in Absolute Return will be in Separately Managed Accounts (“SMAs”), for account transparency and accessibility. While KYUR is responsible for managing the investments in the SMAs, investors have complete access to their accounts, with regards to the balances and activities in the accounts.