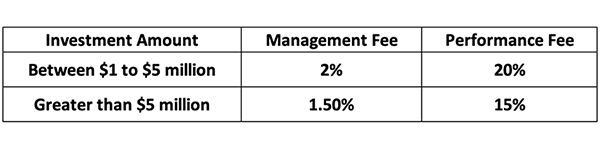

KYUR Pure Alpha SMAs are offered with a minimum investment of $100,000, at an annual fee of two percent (2%) plus performance incentive fee of 20%, but lower on a sliding scale for larger investment amounts.

Actual fees will be determined depending on the investment amount once the account is fully funded.

Investment Strategy

In his time, the name Alfred Winslow Jones was associated with hedge funds perhaps as much as Nobel Laureate Harry Markowitz with Modern Portfolio Theory. In 1966, a “legend in financial journalism,” Carol Junge Loomis, an editor at Fortune, wrote about “the best professional manager of investors’ money these days.” She went on to cite Jones’ investment track record of 325 percent return for the five years ending May 1965, and explained why short selling and leverage can be used for “conservative ends”.

Not many hedge fund managers nowadays adhere to Jones’ teachings or come close to his performance. Many call themselves hedge funds simply because they charge high fees.

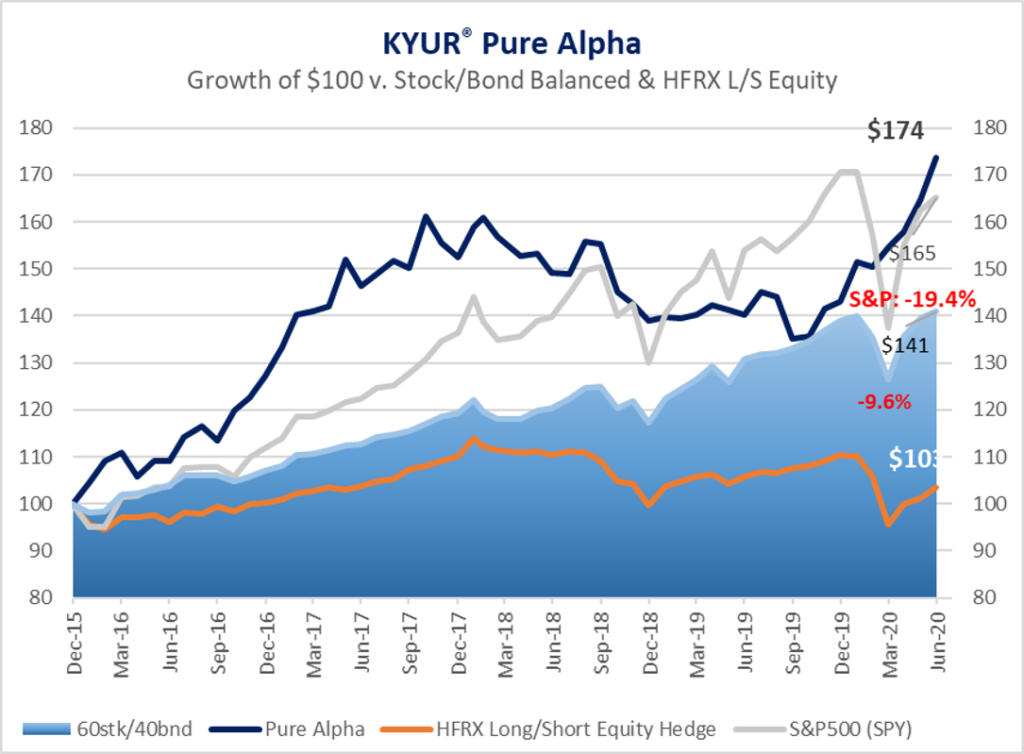

Following Alfred Jones’ footpath, KYUR offers to qualified investors KYUR Market Neutral Pure Alpha that uses “true” short selling to protect investor capital from severe market downturns, as well as to generate excess return, or alpha.

Market-Neutral Pure Alpha invests sufficiently on both the long/buy and short/sell sides so that, in math-speak, the portfolio would be beta neutral. As such, the Strategy seeks to insulate the market’s impact on the portfolio over a normal cycle while participating in the upside.

What generates return for the portfolio?

Driven by the quantitative PMO engine, Pure Alpha seeks out to buy those stocks that possess fundamental strengths and growth prospects that are selling at attractive prices. All stocks are screened through PMO proprietary risk reduction algorithms to calibrate their risks of capital losses. The stocks selected for their fundamental must pass PMO criteria of acceptable risks of capital losses. Those stocks that do not qualify the risk controls are excluded, even if they have desirable return prospects.

History shows that optimal return at lower volatility over a cycle can be achieved with a focus on loss control. Also, because the market is inefficient and prices do not contain enough information about a company, its fundamentals drive the future returns of its stock.

The approximately 5,000 stocks that comprise about 99 percent of the U. S. market are quantitatively ranked according to the above two key factors: their fundamental strengths and their risks of capital losses.

There is a third set of screenings. The top picks, longs or shorts, must also possess the “Catalytic Momentum”, a set of KYUR proprietary factors, not technical analysis, that measure their potential for readiness for a take-off in price gains (for longs) or losses (for shorts).

The highest ranked stocks go into the long/buy side of the portfolio. The lowest are sold short in the short/sell side.

The long side of Pure Alpha holds between 25 to 40 stocks. The short side include up to 50 positions.

Pure Alpha generates positive return to the extent that the “long” stocks go up in value more than any gains registered by the “short” stocks.

If the “long” side increases in value and the “short” side declines, the portfolio benefits even more. Vice versa, if the “longs” decline while the “shorts” increase in values, losses would be higher than otherwise.