KYUR offers a range of Select Equity Strategies, with emphasis on Growth or Income, or some combination of both.

These offerings are in the form of portfolios of 25 to 40 stocks, a much smaller number than most mutual funds.

KYUR’s research has found that the benefits of diversification decline rapidly once a diversified portfolio exceeds 30 stocks. Indeed, beyond 50 individual stocks, the impact or contribution of the residual or non-diversifiable risk of each individual stock becomes negligible, such that the risk of a well-diversified portfolio is largely the risk of the market.

The resultant decline of diversification benefits from a large number of stocks can lead to two possible consequences.

First, a larger portfolio increases the chances that it performs mimicry to the market. To achieve the return stream of the market, an investor may prefer an ETF like SPY –as opposed to a large actively managed fund– for its lower costs, transparency and ease of trading.

Second, the additional securities may be underperforming companies with inconsistent earnings, lesser financial strengths, and are perhaps over-priced. Such added selections could add risks to the portfolio and undermine its performance.

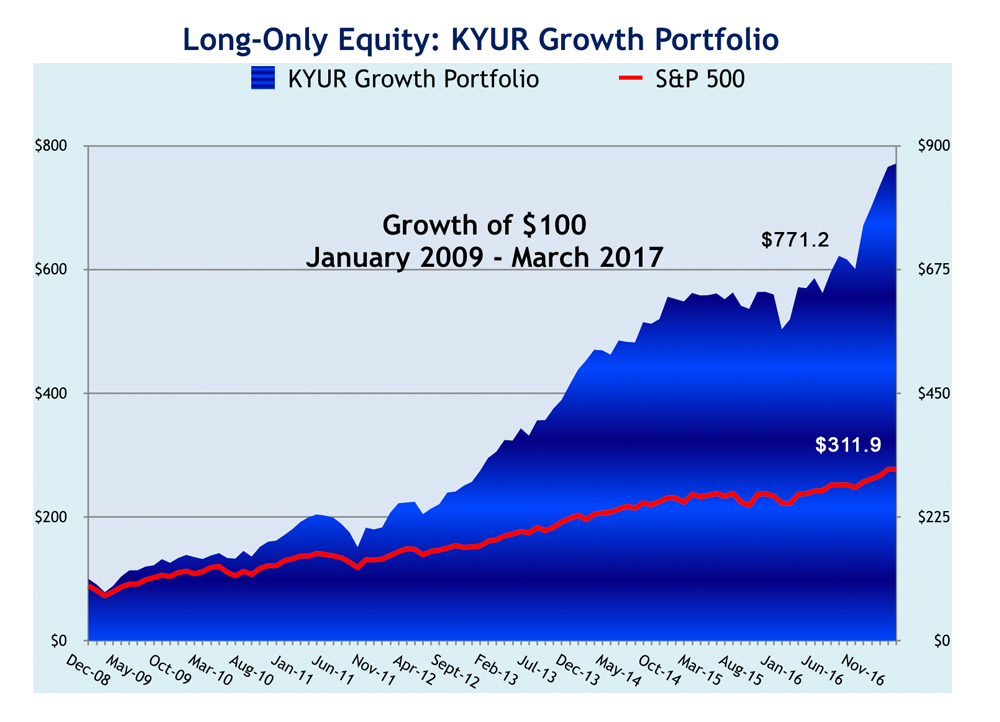

KYUR’s flagship Select Equity Strategy is KYUR Growth Portfolio. See the graph nearby for its history.

KYUR’s flagship Select Equity Strategy is KYUR Growth Portfolio. See the graph nearby for its history.

The Growth Portfolio employs quantitative algorithms to select 25 to 40 stocks to be included in the portfolio. Driven by the PMO engine, the stock selection process includes KYUR proprietary risk reduction algorithms to calibrate the risks of capital losses of individual stocks.

The PMO process seeks out stocks that possess fundamental strengths and growth prospects that are selling at attractive prices. Such stocks, however, must pass PMO’s quantitative screens and criteria of acceptable risks of capital losses. Those stocks that do not qualify the risk controls are excluded from the Growth Portfolio, even if they have desirable return prospects.

KYUR Select Equity Strategies is offered to Accredited Investors.

If you are an accredited Investor, please fill out the certificate below to obtain more information before investing.

[iframe-popup id=”1″]