Events may be correlated, because they happen to be that way; but one does not necessarily cause the other, and vice versa.

Like predicting the direction of the stock market based on the results of the Super Bowl games.

For a number of years in the 1990s, if the NFC team won the championship, the stock market would go higher in that year; the market would go down if the AFC team won the prize. It became a guiding principle for stock market pundits.

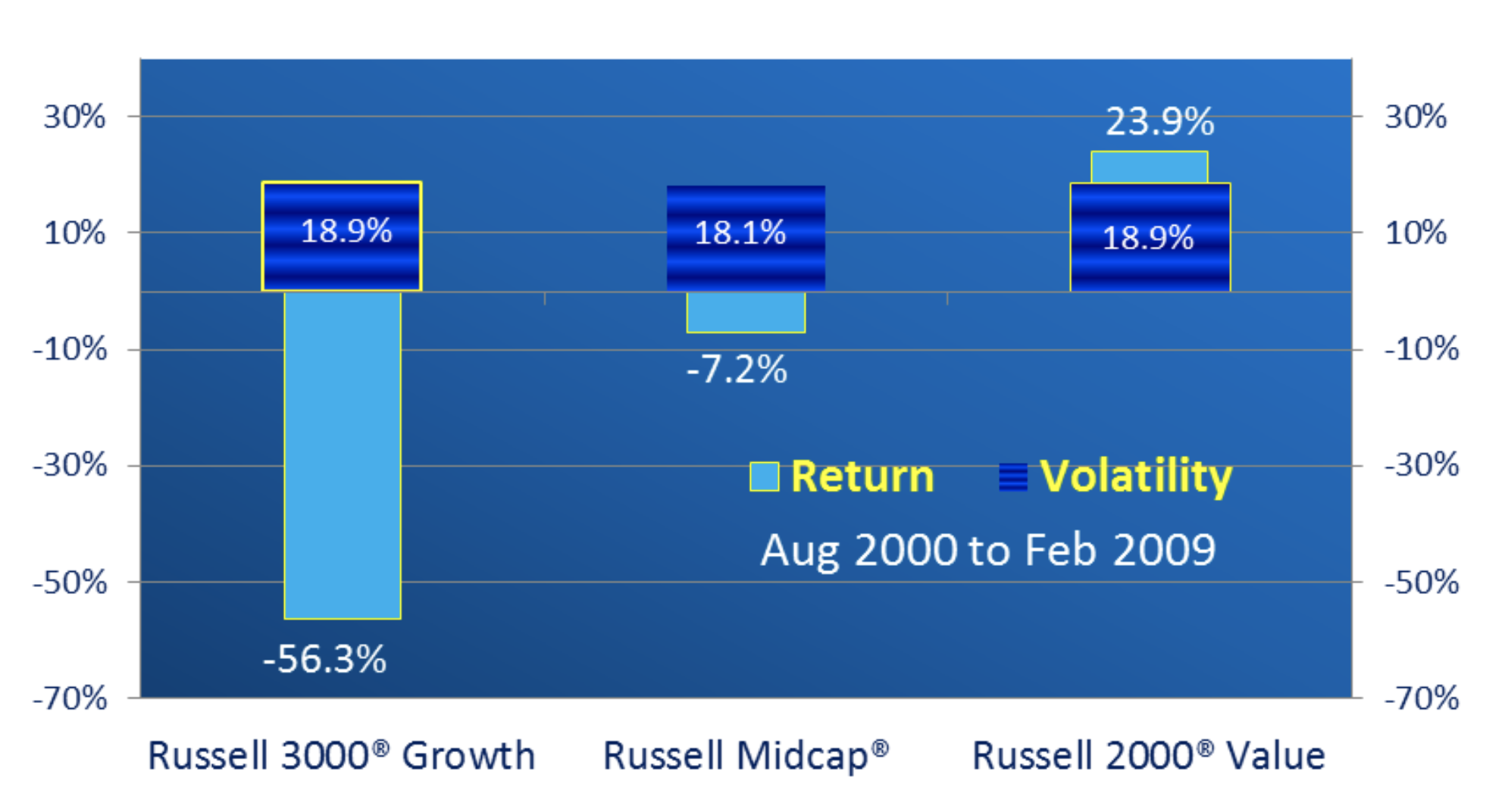

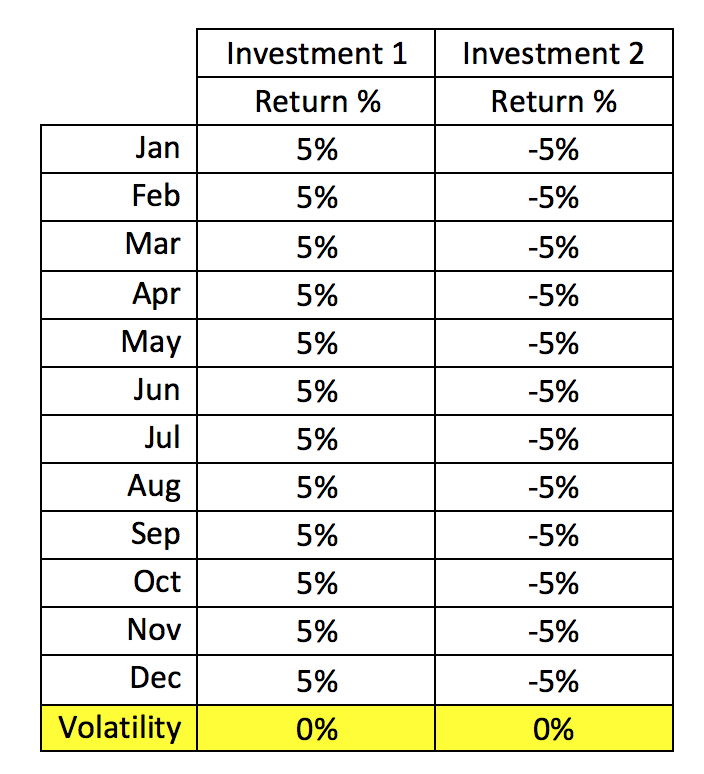

Real-world experience shows there is no established causal relationship between volatility and return.