Benefits of Loss Control – The Law of Compounding to Grow Wealth

Loss control allows gains to accumulate over time and produce optimal returns. However, in certain periods and market conditions, this strategy may result in your investments lagging behind market benchmarks. This can happen especially in strongly rising markets when securities are valued at unusually high multiples relative to their intrinsic values; or when markets are in “Irrational Exuberance” as former Federal Reserve Board Chairman Alan Greenspan described the stock market conditions about a year before Black Monday in 1987 when the Dow Jones Industrial Average crashed 22.61%, all in one day.

At the same time, loss control allows more consistent accumulation of wealth. For example, after a loss of 10% in year 1, your investment would need a gain of 11.1% the following year to get back to the original amount. If this loss was avoided, and year 1 produced zero gain, a small return in the second year, say, 3% would put you ahead, $103 – even though nominally your investment “underperforms” in the second year.

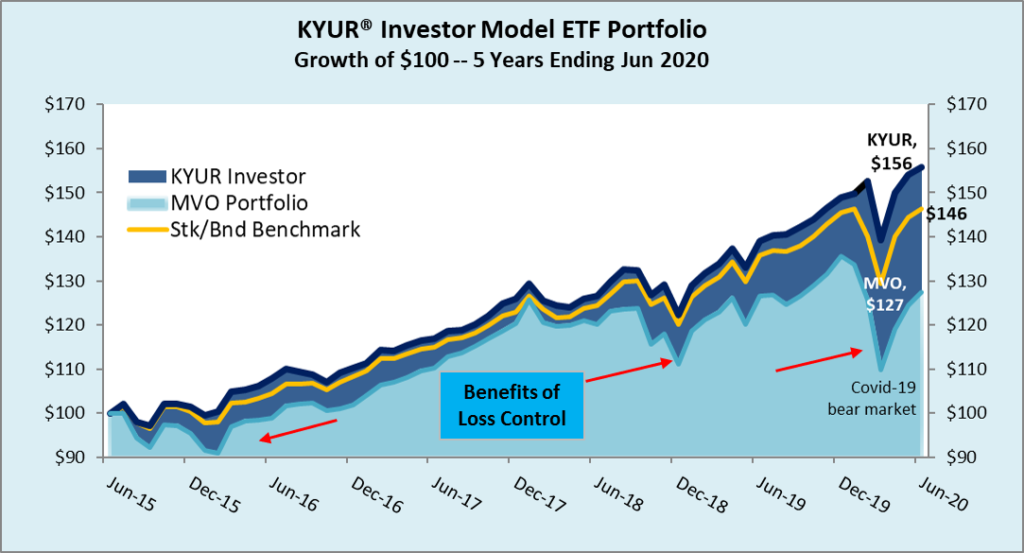

A vivid case of why loss control is critical to growing wealth is the market conditions in the three years ending March 2017; see the chart nearby.

As the conditions in the stock markets became negative, stocks took a tumble in summer of 2015, continuing till spring 2016. However, KYUR Investor Model Portfolio declined only modestly, not having a big loss to recover from. With this stronger footing, KYUR Investor Portfolio recovered in subsequent months, and continued to advance as markets kept rising.

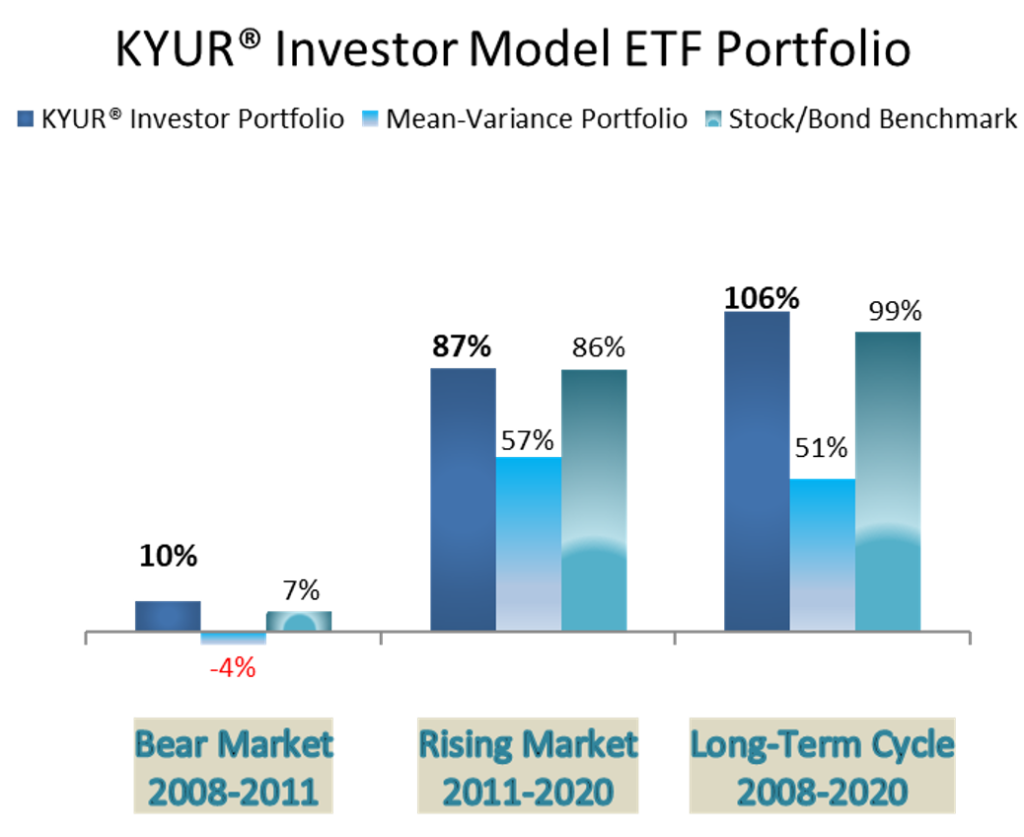

Importantly, loss control reduces risks and amounts of capital losses in bear markets, such as the financial crisis of 2008.

Minimizing potential losses in financial upheavals help sleeping better! Containing losses in such worrisome market conditions not only help protect capital, it helps keeping calm to make rational decisions. For many, it means not having to cut back on such essentials as saving for college, buying a house, or gifts for loved ones on special occasions. Perhaps most important of all, not having to delay retirement because of large losses due to the market crashing. Such was the situation of many in the aftermath of the 2008 crisis.

KYUR offers three categories of ETF portfolios: Saver, Investor, and Wealth Creator Portfolios. Each portfolio category has multiple variations to suit your risk tolerances. The ETFs in the three Portfolios may be different although some may overlap. Also, the methodologies to construct them are different. This is because the value functions or behavioral reactions to risks are different among different individuals; in math-speak, they are neither linear nor uniform with regards to gains or losses. This real-world behavior is demonstrated clearly by 2002 Nobel Laureate Daniel Kahneman and other innovators in behavioral finance and Modern Portfolio Theory.

To invest in the three ETF Portfolios, you are invited to click here.