The quantitative PMO engine encapsulates recent discoveries in MPT-derived algorithms and behavioral economics. These innovations have brought new and real-world understandings of risk attitudes and more realistic measures of investment risks. In particular, the newly formulated algorithms reflect the reality that investors are particularly concerned about risks of losses to their capital, more so than the up and down movements, particularly in rising markets. Furthermore, in “Prospect Theory” the 2002 Nobel Laureate in Economics Daniel Kahneman and Amos Tversky demonstrate that investors feel greater pain from a loss than satisfaction from gains of the same amount. Behavioral factors have also been found to frame and shape investor attitudes toward risks.

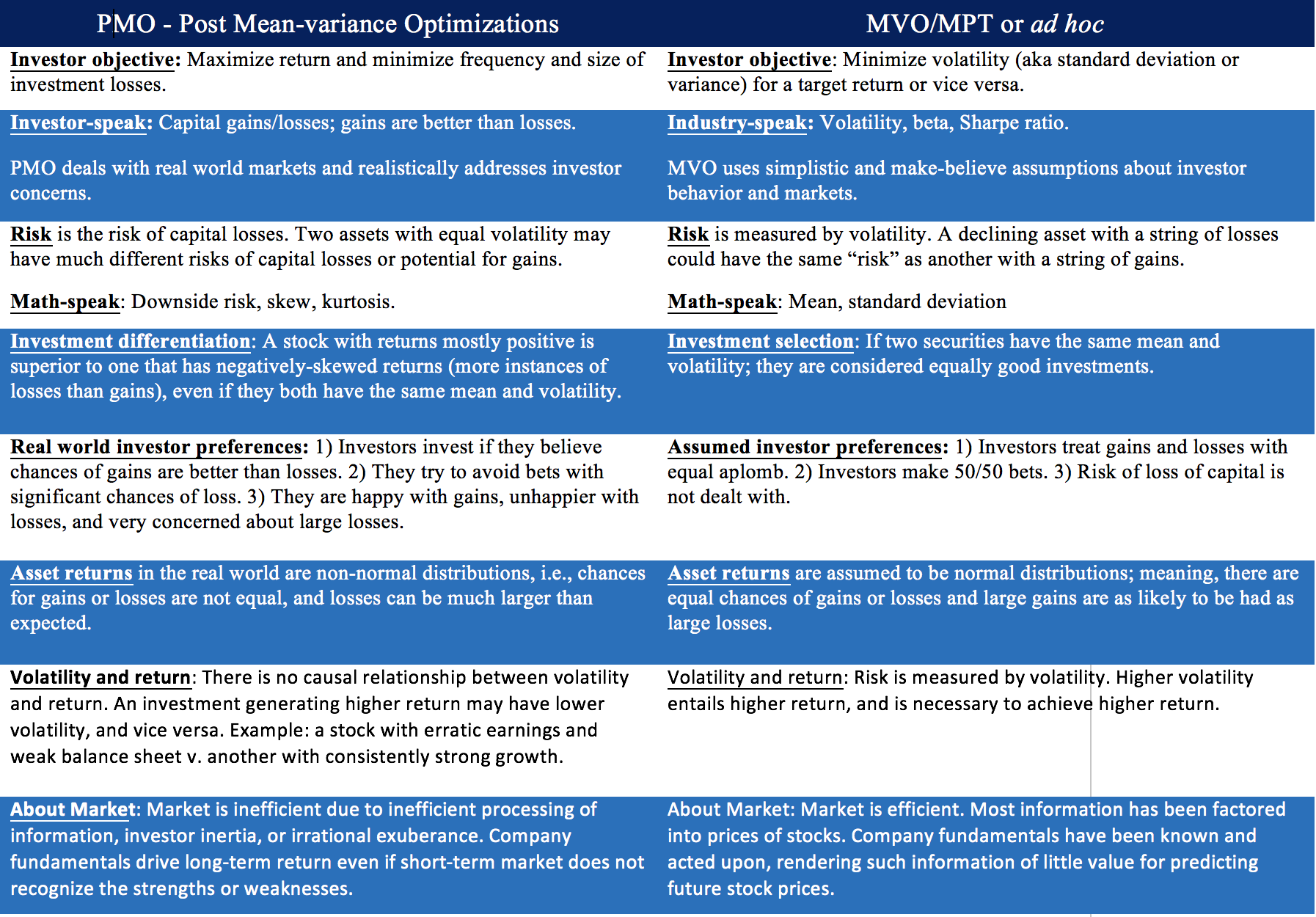

Below is a side-by-side comparison of criteria to portfolio optimization and portfolio construction embedded in PMO, versus traditional ad hoc and Mean-Variance Optimization approaches.