Risks are paramount and ever present in investing. In good times, risks recede into the background, they draw little attention and seem non-existent. That’s why when market conditions turn negative, usually without much warning, fear takes over, triggers unplanned action even by experienced investment professionals; and losses are magnified undermining investors’ long-term investment goals and possibly their long-cherished life styles.

In investment, Modern Portfolio Theory (“MPT”) created in 1952 by the Nobel Laureate Harry M. Markowitz has dominated the thinking and practice of making investment decisions, to this very day.

Briefly, MPT stipulates that investment decisions depend on two variables: risk and return –and only these two variables. To construct portfolios of risky securities, the measurement of “risk” is all-important ––to correctly calculate the risks of the portfolios, to determine whether the potential return of each portfolio is commensurate with its risk, and importantly, whether the recommended portfolio’s risk is suitable for a specific investor.

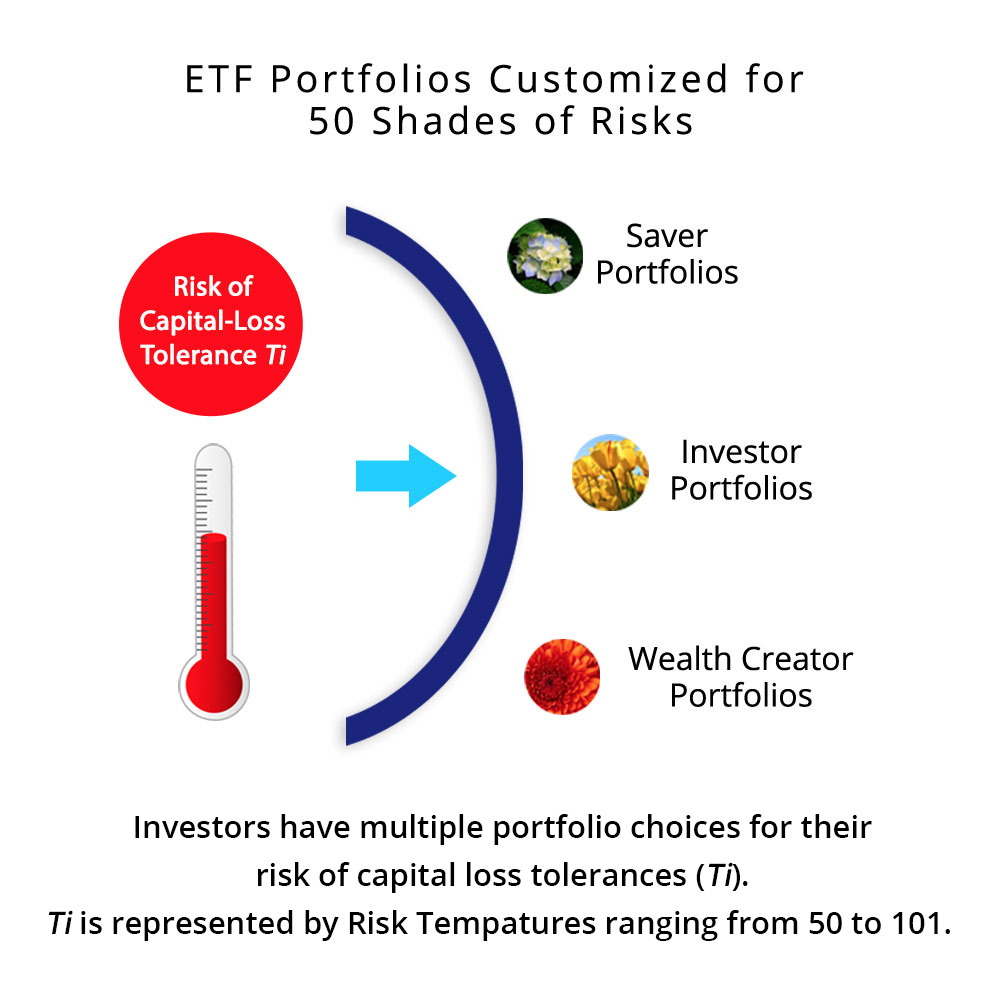

Managing the risks of your investments is paramount to KYUR.

Managing the risks of your investments is paramount to KYUR.